First, check to see if you have a tax number already

Your employer may have registered you in the past. If this is the case, you would have been issued with a 10-digit tax reference number from SARS and you would have an IT150 Notification of registration that states your reference number.

You can also check your IRP5 or payslip from your employer as your tax reference number may appear there.

If you think you *might* have a tax number but aren't sure, you can phone SARS at 0800 00 7277 to check.

Or you can request it on the SARS SMS Channel by sending an SMS to SARS on 47277 from your mobile device.

-TRN (Space) ID number/Passport number/ Asylum Seeker number

Or you can request it on the SARS USSD Channel by typing, on your mobile device, a string of characters that comprises of an asterisk (*), followed by a few digits and ending with a hashtag (#) and dialing.

Steps on how to request tax services via the SARS USSD Channel

Step 1: Initiate USSD by dialing *134*7277#

Step 2: Select the service you require

Step 3: Taxpayer Verification – SARS will request you to complete either your, ID/Passport/Asylum Number

Step 4: Tax Resolution – Upon successful verification by SARS, a response will be displayed

Or you can request it online by visiting the SARS website.

On the top menu bar, click on "Contact Us".

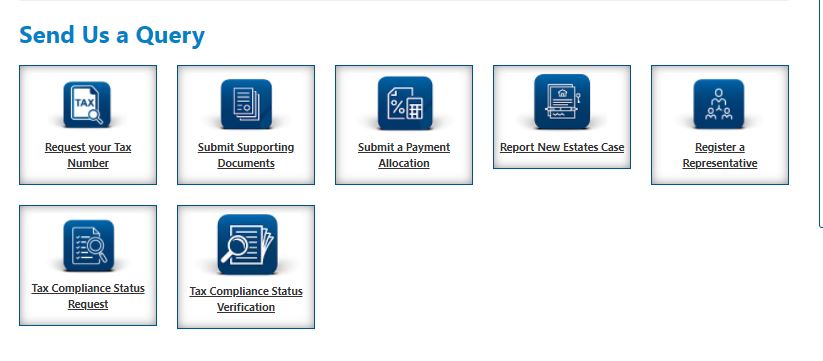

Click on the "Request your Tax number"

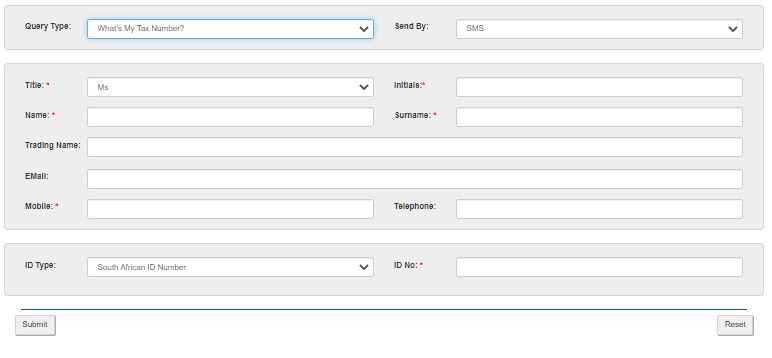

Complete the form and choose "What's My Tax Number" as the query type

SARS will send you your tax number if they were able to verify your credentials.

If you have not registered then you can do so on eFiling or at a branch.

Registering for a tax number via eFiling

Getting a tax number is now as easy as registering on SARS eFiling. Simply register on eFiling and if you do not yet have a personal income tax number, SARS will automatically register you and issue a tax reference number. You are required to have a valid South African ID. For more information see the step-by-step guide to register for eFiling and register for Personal Income Tax automatically.

Registering for a tax number at a branch

(please note, book an appointment First before visiting the SARS branches)

There are three options to make an appointment if you are a registered taxpayer:

Take the following documents to your nearest SARS branch to register as a taxpayer:

SARS should register you on the SARS system and provide you with your new tax number immediately!

You should receive your tax number by post sometime after your in-branch registration in the form of an IT150 / Notification of registration. If you would like to call SARS (0800 00 7277) to find out what the current status of your registration is, remember to have your ID number with you for the call.

Register with TaxTim now and we will help you through the next steps of becoming tax-compliant.

Updated 15 May 2024

Submit your tax return right here!

TaxTim will help you:

Do Your Tax Return Easily

Avoid penalties

Maximise your refund

Tim uses your answers to complete your income tax return instantly and professionally, with everything filled in in the right place.

Let Tim submit your tax return direct to SARS in just a few clicks!