Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first chapter of each course. Start Free

The percentage of completion method is a revenue recognition accounting concept that evaluates how to realize revenue periodically over a long-term project or contract. Revenue, expenses, and gross profit are recognized each period based on the percentage of work completed or costs incurred.

The percentage of completion method falls in line with IFRS 15, which indicates that revenue from performance obligations recognized over a period of time should be based on the percentage of completion. The method recognizes revenues and expenses in proportion to the completeness of the contracted project. It is commonly measured through the cost-to-cost method.

There are two conditions to use the percentage of completion method:

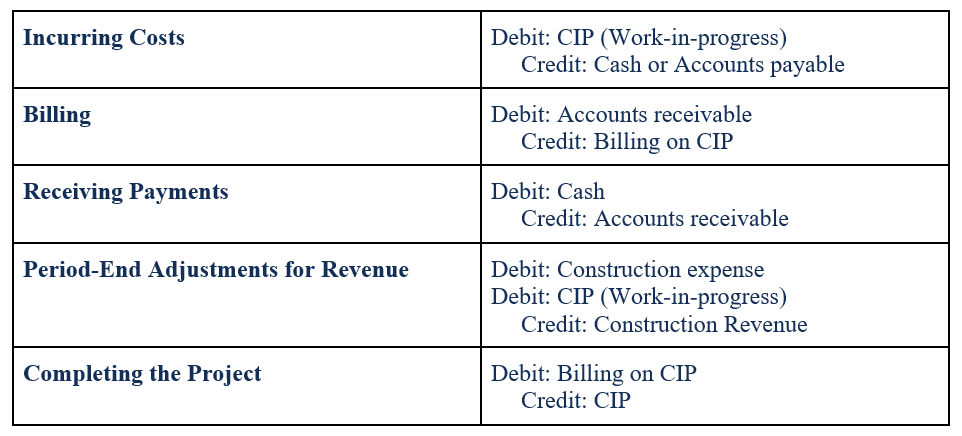

Journal entries for the percentage of completion method are as follows:

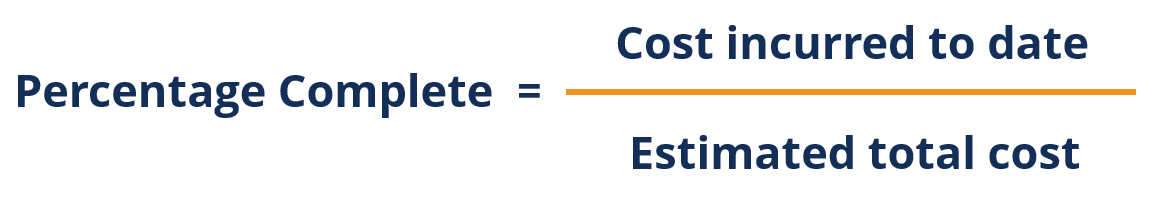

In the cost-to-cost approach, the percentage of completion is based on the costs incurred to the estimated total cost to complete the project. Therefore, the equation for the cost-to-cost estimate of percentage completion is:

Percentage complete:

Revenue recognized:

An example is provided below to clarify the cost-to-cost approach.

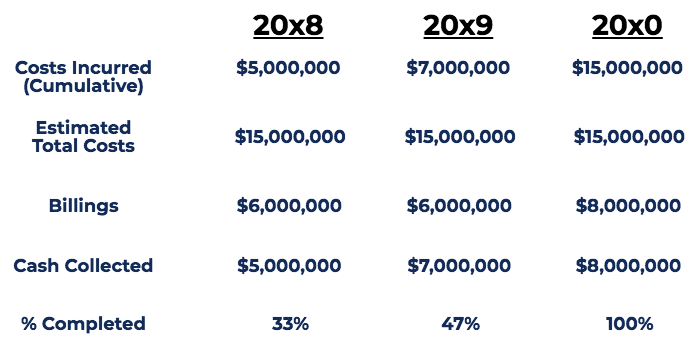

StrongBridges Ltd. was awarded a $20 million contract to build a bridge. The estimated time to complete the project is three (3) years, with an estimated cost of $15 million. Assuming that the cost estimates do not change, the project is expected to generate $5 million in profit. The following is a schedule on the project:

Notes:

For the schedule above, revenues recognized under the percentage of completion method:

Total Revenue = $20,000,000

Costs recognized under the percentage of completion method:

Total Cost = $15,000,000

Profit recognized under the percentage of completion method:

Gross Profit = $5,000,000

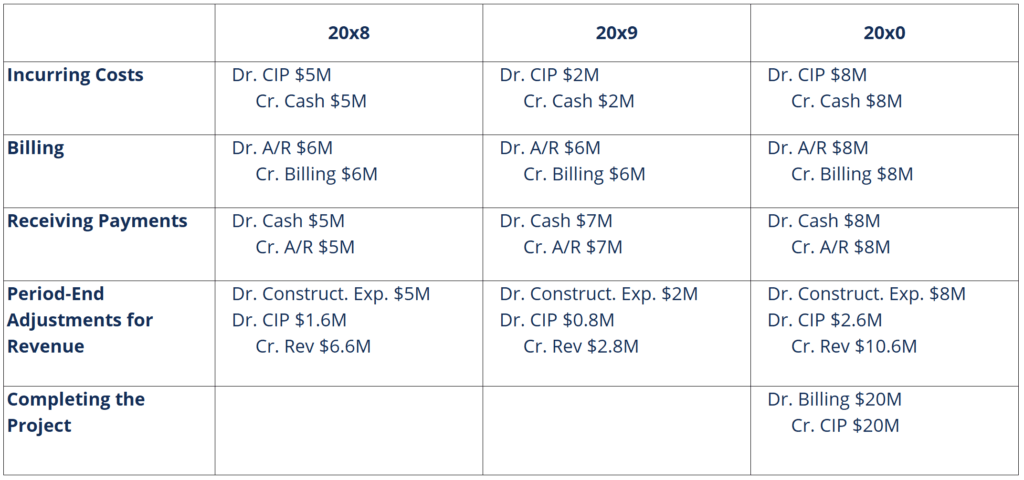

Journal entries for the example above would be as follows:

Thank you for reading CFI’s guide to the Percentage of Completion Method. To keep learning and developing your knowledge of financial analysis, we highly recommend the additional CFI resources below:

Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst.